It’s already February. How time flies. And how are your goals going, especially your financial goals? Most of us would have started the year with one goal or another – could be working out, eating healthy and perhaps a financial goals. It could be saving for your emergency fund, wedding, house renovation or starting a regular investment habit.

Many of us start the year raring to go in January. But come a few weeks and it’s not a surprise that the same enthusiasm would have dimmed or some might have given up altogether. If anything, fitness clubs are the best telling signs as the January crowd dwindles.

It’s easy to lose the momentum due to various reasons; whether it’s having unrealistic goals, not building a system to sustain the habit for the longer term, giving up too early or mindsets that are holding us back.

Fortunately, it’s not impossible to achieve our financial goals and stick to our money habits. It’s been a few years that I first wrote down my financial goals of saving for my emergency fun and to start investing consistently. I’m glad that I have been keeping to them and now working togethers my retirement fund. In fact, my financial habits have now become second nature to me without requiring me to give up all my spending and enjoyment. Contrary, it has helped me to prioritise on spending on what matters most to me.

Let me share what are the 5 simple but life changing principles that have helped me in achieving my emergency fund, reward myself and still build my retirement fund.

1. Have big goals but create baby steps

I believe in setting big goals and more importantly goals that align with who I want to become. In my case, I wanted to prioritise my mental health and also have some form of independence, hence prioritising a “quit it fund” that will allow me to take a break from any toxic workplace was important.

But beyond just setting big goals, what is more important is breaking the big sized goal into smaller milestones. Without smaller milestones, a big goal will appear unattainable and is a sure detractor from us starting on any journey. Imagine trying to aim to run a marathon without conquering your first 1km. Pretty daunting wouldn’t it?

So how do you build baby steps when it comes to a financial goal? Let’s look at the example of a financial goal to build an emergency fund. Assuming you will need to build a fund worth of six months of living expenses and you have a monthly expense of RM5,000. That would be equivalent to an amount of RM30,000. It can appear to be quite a huge amount to save. But assuming you break it down to a longer time frame and smaller milestones; it could look like a savings of RM2,500 a month over a 12 month journey. And if you break it down further it would be about RM83/a day. Now all of a sudden, the large goal has become smaller milestones that is conquerable.

Now when you have broken it to smaller milestones, you can craft the baby steps around it. A good way to start is to start reviewing your monthly expenses and see what are the options for you to reduce your spend.

In my case, when I started building my emergency fund, I started by focusing on reviewing the bigger ticket spend as that was where it gave the most room of expense optimisation. I find areas such as accommodation and transport to be usually the bigger ticket expenses. For example, instead of renting a whole place, options could be renting a room to minimise on rental as well as on bills.

And you can use the sample principle of baby steps to your bigger goal. I still use it when it comes to my retirement planning.

2. Budget but make room to reward yourself

As simple as it sounds, creating a budget and tracking it really one of the foundations of building money habits that will help you achieve many of your financial goals. I like how Dave Ramsey describes budgeting as telling your money where to go instead of wondering where it went. However, many people fail to keep at budgeting and I think some of the reasons could be the mindset we attach to it as well as the extremity of the measures that can be taken. Most would view budgeting as a behaviour that limits our enjoyment because we think it’s about asking us to not spend at all. But how about reframing our mindset of budgeting to one that says we are reprioritising our money to enjoyment that mattered most to us?

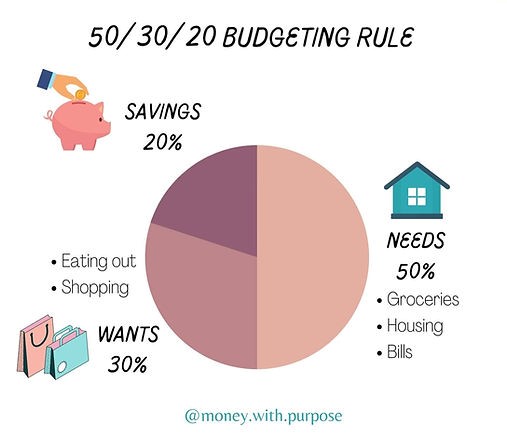

Hence I know that it is important for me to make room for pleasures without my budget. I knew if it was strictly frugality without some pleasure, I would give it up all too quickly. The popular rule of budgeting is a 50/30/20 rule which allocates 50% to necessity, 30% to wants and 20% to your savings. I think it’s a great way to help us think about the major categories of our spend. As for the percentages, I do not consider them hard and fast rule but rather than guidelines for my own budgeting.

When I started out on the journey of budgeting and tracking my spend, I discovered there was a lot of mindless spending. Why I call them mindless spending is because I discovered that they did not necessarily add value to my life. I was spending on frequent holiday trips that gave me short escapisms but seldom needed rest, clothes because they were on sales that would land up in a corner of my wardrobe and gym membership that were more like donations since I hardly visited the gym.

I started making conscious decisions to curb these spending but still made room for what mattered more such as prioritising trips that were on my bucket list and investing into courses where I really wanted to grow my expertise. Whilst I spent less on my wants, I felt more fulfilled because there was intentionality in my spend and I was still rewarding myself. Initially I started tracking more diligently by using a budgeting app to track all my expenses. But now it has become so second nature that I review my expenses mostly on a monthly basis. For those looking for a budgeting app, I use the Bluecoins app which is free.

3. Make the habits easy and where possible, automate

In the best seller Atomic Habits by James Clear, he talks about how 4 simple steps can help build better habits. One of those is to make the habit easy.

He talks about how most conventional wisdom says that motivation is the key to habit change. Whilst it is important, our real motivation is to be lazy and to do what is convenient which is true when we consider the behaviour that fills up our time such as mindless scrolling on our phones and watching Netflix.

And I can’t agree more. It might appear some people have the discipline of a Navy SEAL but I know I’m not one of them. Hence when it came to building my habit of investing, I knew I needed to start with the path of least resistance which is to automate it.

Some would say picking the best stock and timing is the way to generate best returns. But for me personally, after a long day or a long week at work, my motivation to research and invest regularly would be rather sporadic. Hence, rather than leaving it to the chance of me being disciplined, I automate it by having it direct debited every month. So instead of aiming to pick the best timing every other month which will result in a lot more effort, I review my long term investment choice annually then automate the habit.

4. Start small, start not knowing all of it but start anyway

One of the hardest part of any journey is probably the first step but it does get easier doesn’t it? Just like first learning how to drive, cycle and any new skill for that matter. And the first step can be especially challenging when it comes to the area of investing if you are a perfectionist and overthinker. The natural inclination is to think you need to understand everything before being able to take any action.

In the same book, James Clear explained the difference about motion vs taking action. They both look similar but are fundamentally different. When we are in motion, we are busy learning, planning and strategizing but all these actions do not produce results. On the other hand, it is action that delivers outcome.

And when it comes to the perfectionist and overthinkers, there is high likelihood of more motion than action. Researching all about investing is motion but it will not deliver an outcome. It is only action when I deposit the money into an investment. Of course the first step can be scary for some but that’s when starting small helps because even if you make a mistake, the risk is really low. But what I have learnt is that action provides clarity and learning more than researching. By starting later rather than later, it was actually depriving me of the opportunity to learn. And starting allowed me to gain the confidence.

5. Even if you stumble, keep going

It is common to hit some bumps along your financial journey. Maybe a bout of emotional spending hit or some emergency spend happened. Or maybe your investment choice didn’t do too well.

And when that happens, it is tempting to say why bother. But the financial journey is a marathon and not a sprint. The results don’t happen overnight, but it sure happens over time. Neither is a habit built overnight.

As you continue and look back a few years down the road, I can safely assure that you will be grateful you took those steps to building those habits. Because I know I surely am. So for those who haven’t started, I encourage you to go from “One day I will start to making it your Day One of starting”. And for those who have started and stopped, hit restart and celebrate your progress rather than just the finish line